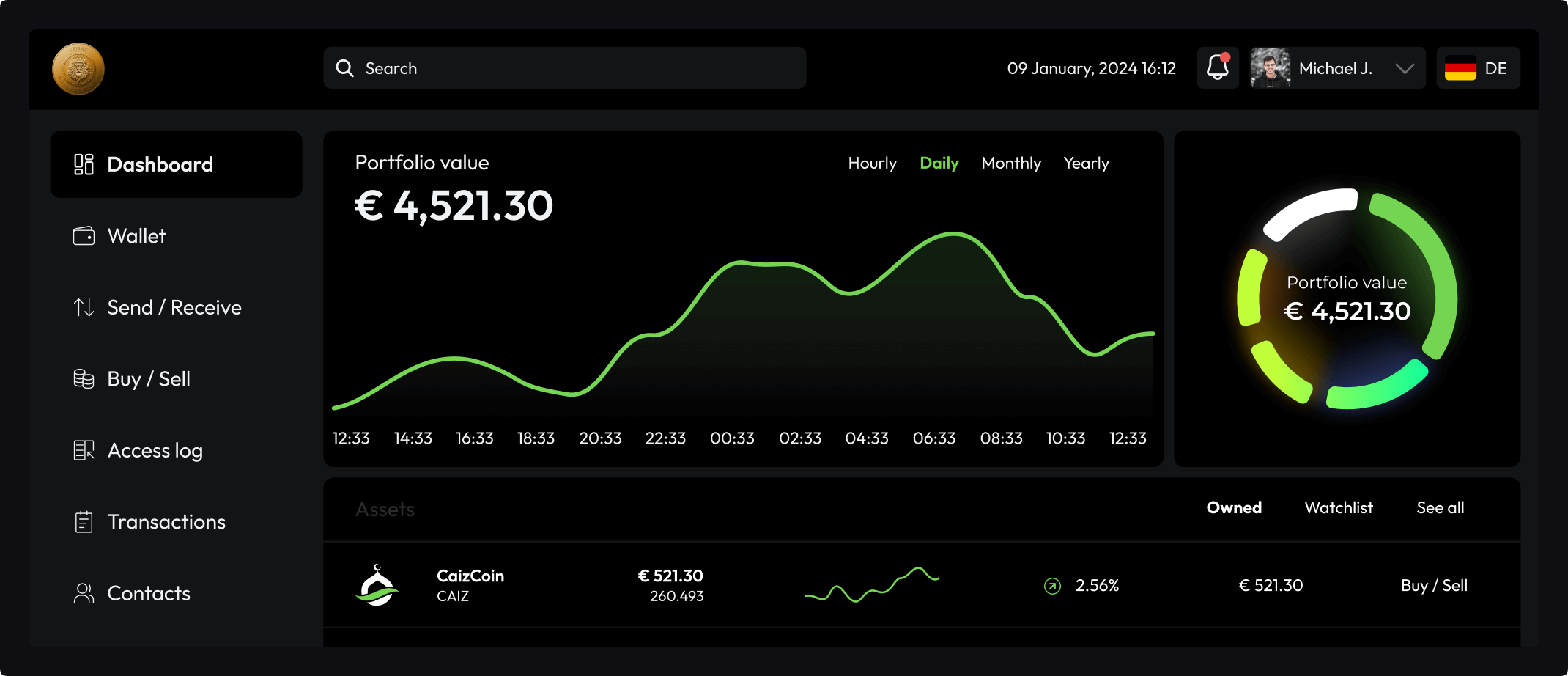

Lemax, where innovation meets investment. Our groundbreaking an platform is poised to revolutionise the Lemax landscape through.

Our team of experts has meticulously crafted Lemax address the key a challenges facing

With Lemax, investors have the chance to a participate in a project that not only offers.

Our experienced team is dedicated to Lemax building platform that streamlines processes.

June 20, 2025

June 20, 2025

855,000 BCC (8.2%)

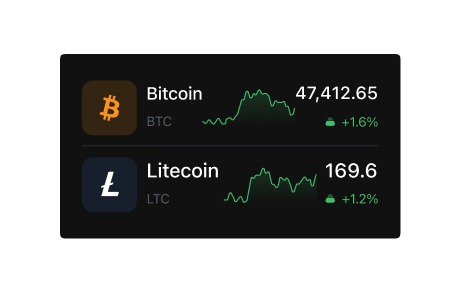

BTC, ETH, LTC

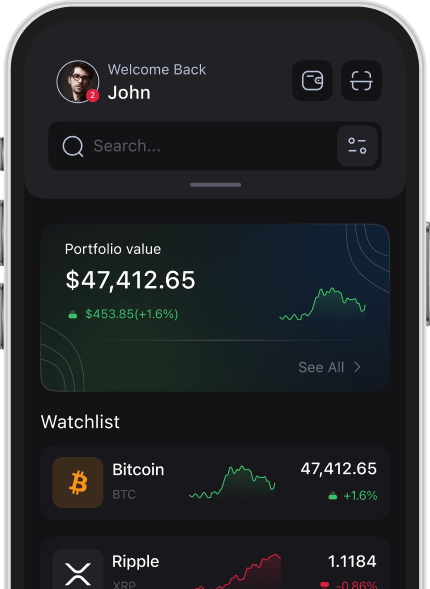

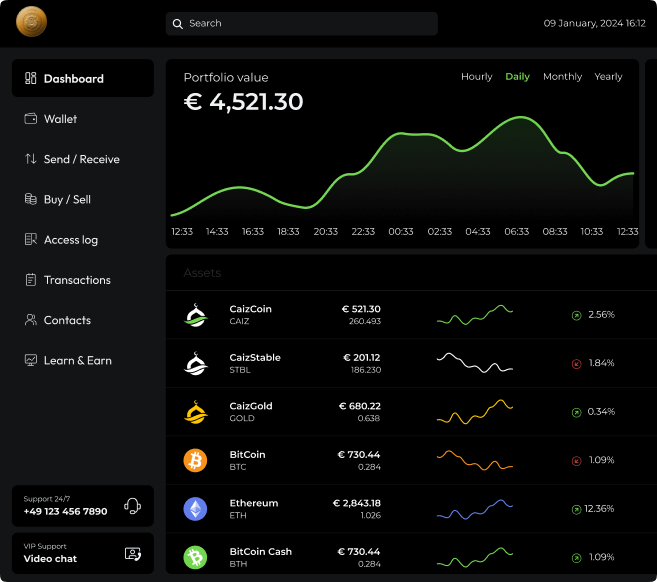

Bitcoin is received, stored, and sent using software known as a Bitcoin Wallet. Download the official Bitcoin Wallet for free.

Our team ultimate solution for Lemax. By leveraging safe blockchain technology, we're revolutionising safe & secure.

ICO, you're not just investing in a project – you're investing in a vision for a brighter future. Join us today and be part of Coin.

Step

Before approaching an exchange, ensure your token and project are well-prepared:

Whitepaper – A detailed document explaining your tokenomics, use case, and roadmap.

Website & Branding – A professional website with clear information about your project.

Community & Social Media – Active presence on Twitter, Telegram, Discord, and other platforms.

Smart Contract Audit – Get a security audit from a reputable firm like CertiK or Hacken.

Tier 1 (Major Exchanges) – Binance, Coinbase, Kraken (high fees, high credibility).

Tier 2 (Mid-Level Exchanges) – KuCoin, Gate.io, OKX (easier to list, good volume).

Tier 3 (Smaller Exchanges) – MEXC, BitMart (lower requirements, fast listing).

Pick an exchange that fits your budget and target audience.

Step

Step

Each exchange has different criteria, but common requirements include:

Strong Trading Volume – Your token should have liquidity and active trading.

Market Demand – The exchange checks how many people are interested in your token.

Legal Compliance – Some exchanges require KYC (Know Your Customer) and legal documentation.

Most major exchanges have an official listing application form on their websites. You need to provide:

Project details (whitepaper, team info, legal docs).

Tokenomics (supply, vesting schedule, utility).

Community size and engagement metrics.

Funding and liquidity details.

After submission, expect a review process that can take weeks or months.

Step

Step

Many exchanges charge a listing fee that can range from $50,000 to $2 million, depending on the exchange.

Some exchanges also require you to provide liquidity for trading pairs (e.g., ETH/USDT).

Negotiate terms if possible—some exchanges offer free listings for strong projects.

Once approved:

Work with the exchange’s technical team to integrate your token.

Provide smart contract details and conduct a security check.

Run test transactions to ensure smooth trading.

Step

Step

A successful listing requires strong marketing:

Announce the listing on social media, Telegram, Discord, and crypto news websites.

Conduct Airdrops & Trading Competitions to attract traders.

Partner with influencers and crypto communities for wider exposure.

Once live, ensure healthy trading volume:

Use Market Makers to stabilize price movements.

Continue promoting your project to drive new buyers.

Provide customer support to address investor concerns.

Step

Step

Before approaching an exchange, ensure your token and project are well-prepared:

Whitepaper – A detailed document explaining your tokenomics, use case, and roadmap.

Website & Branding – A professional website with clear information about your project.

Community & Social Media – Active presence on Twitter, Telegram, Discord, and other platforms.

Smart Contract Audit – Get a security audit from a reputable firm like CertiK or Hacken.

Step

Tier 1 (Major Exchanges) – Binance, Coinbase, Kraken (high fees, high credibility).

Tier 2 (Mid-Level Exchanges) – KuCoin, Gate.io, OKX (easier to list, good volume).

Tier 3 (Smaller Exchanges) – MEXC, BitMart (lower requirements, fast listing).

Pick an exchange that fits your budget and target audience.

Step

Each exchange has different criteria, but common requirements include:

Strong Trading Volume – Your token should have liquidity and active trading.

Market Demand – The exchange checks how many people are interested in your token.

Legal Compliance – Some exchanges require KYC (Know Your Customer) and legal documentation.

Step

Most major exchanges have an official listing application form on their websites. You need to provide:

Project details (whitepaper, team info, legal docs).

Tokenomics (supply, vesting schedule, utility).

Community size and engagement metrics.

Funding and liquidity details.

After submission, expect a review process that can take weeks or months.

Step

Many exchanges charge a listing fee that can range from $50,000 to $2 million, depending on the exchange.

Some exchanges also require you to provide liquidity for trading pairs (e.g., ETH/USDT).

Negotiate terms if possible—some exchanges offer free listings for strong projects.

Step

Once approved:

Work with the exchange’s technical team to integrate your token.

Provide smart contract details and conduct a security check.

Run test transactions to ensure smooth trading.

Step

A successful listing requires strong marketing:

Announce the listing on social media, Telegram, Discord, and crypto news websites.

Conduct Airdrops & Trading Competitions to attract traders.

Partner with influencers and crypto communities for wider exposure.

Step

Once live, ensure healthy trading volume:

Use Market Makers to stabilize price movements.

Continue promoting your project to drive new buyers.

Provide customer support to address investor concerns.

Being part of this Token journey has been nothing short of extra. The team's dedication to transforming to the Lemax blockchain technology is palpable, and their commitment to transparency and excellence.

One of the most significant advantages of ICOs is their ability to democratise.

Read More

In recent years, Initial Coin Offerings Of (ICOs) have emerged as revolutionary

Read More